AeroClean Stock: Too Many Risks Despite Some Positive News

shapecharge/E+ via Getty Images

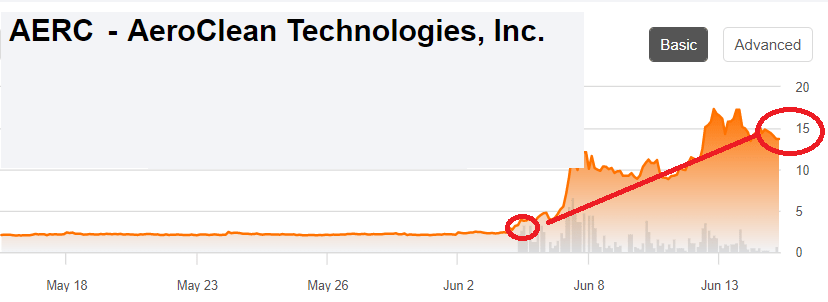

AeroClean Technologies, Inc. (NASDAQ:AERC) reports a massive target market, and expects double digit sales growth in the near future. The FDA classified the company’s technology Pūrgo as a Class II Medical Device, which generated significant stock demand. The stock price recently increased from less than $2 to more than $15. With that all being said, I believe that the company is overvalued as market participants are too optimistic about future cash flows. I devised a simple DCF model and obtained a stock valuation that is significantly lower than the current market price. Finally, there is a client concentration risk, and the global logistics and supply chain bottlenecks could lower future manufacturing.

AeroClean: Massive Target Market, But Also Some Risks

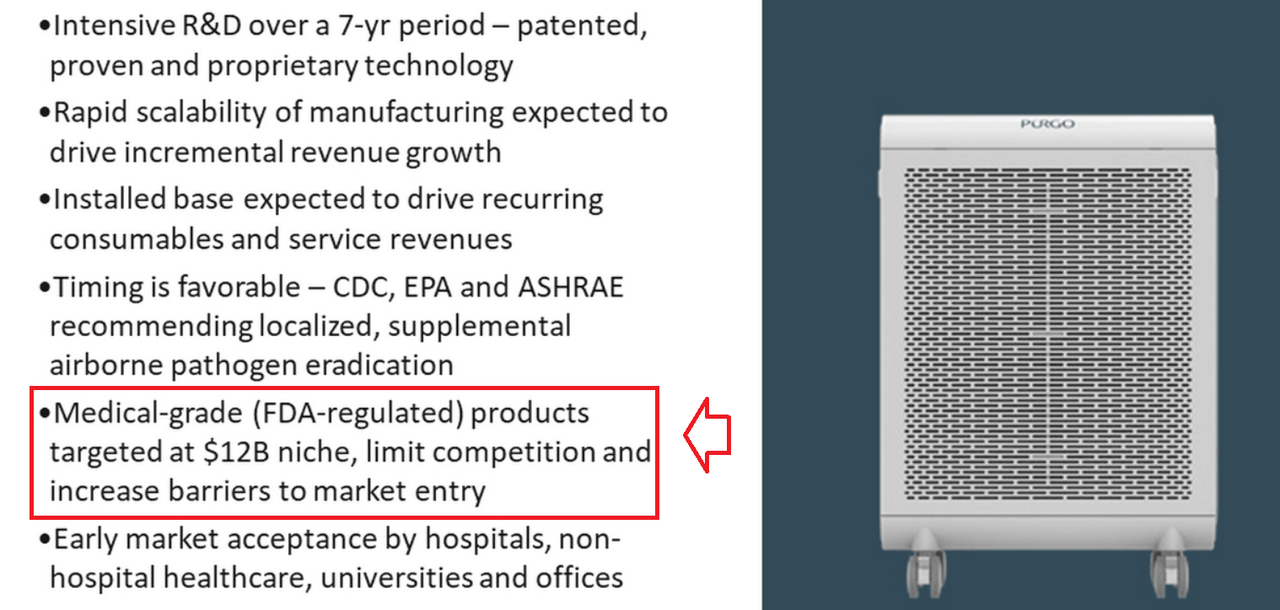

AeroClean offers interior space air purification technology to fight harmful airborne pathogens in the medical industry, schools, colleges, elevators, and other target markets.

The company claims intensive research and development for a period of more than 7 years and a massive target market. Keep in mind that only the medical grade devices target a niche of $12 billion.

Investor Presentation

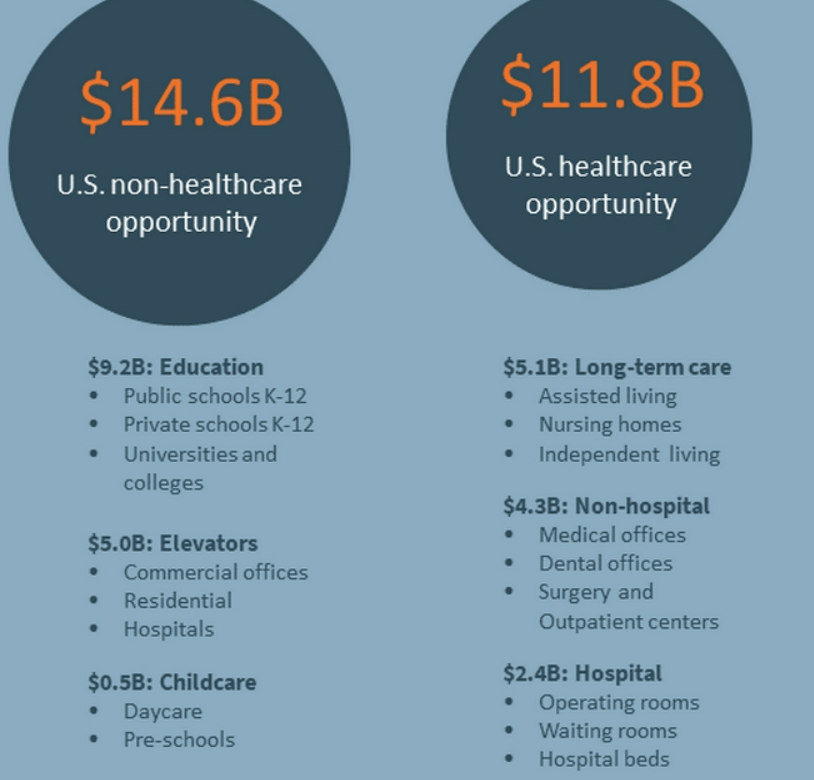

The non-healthcare opportunity includes elevators, childcare, and education, which sums up to $14.6 billion in sales. Considering that AeroClean makes less than $100 million in revenue, there is significant room for improvement in terms of revenue growth. The target market is large.

Investor Presentation

I am right now talking about AeroClean because very recently management announced that the FDA had officially classified AeroClean’s Pūrgo technology as a Class II Medical Device. Many traders bought shares, and there appears to be a significant demand for the stock. The stock price spiked up from around $2 to more than $15.

AeroClean Technologies announced that the U.S. Food and Drug Administration has granted AeroClean’s Pūrgo technology 510k clearance, classifying it as a Class II Medical Device. Source: AeroClean Receives FDA Clearance For Pūrgo Medical Grade Air Hygiene Technology – AeroClean

SA

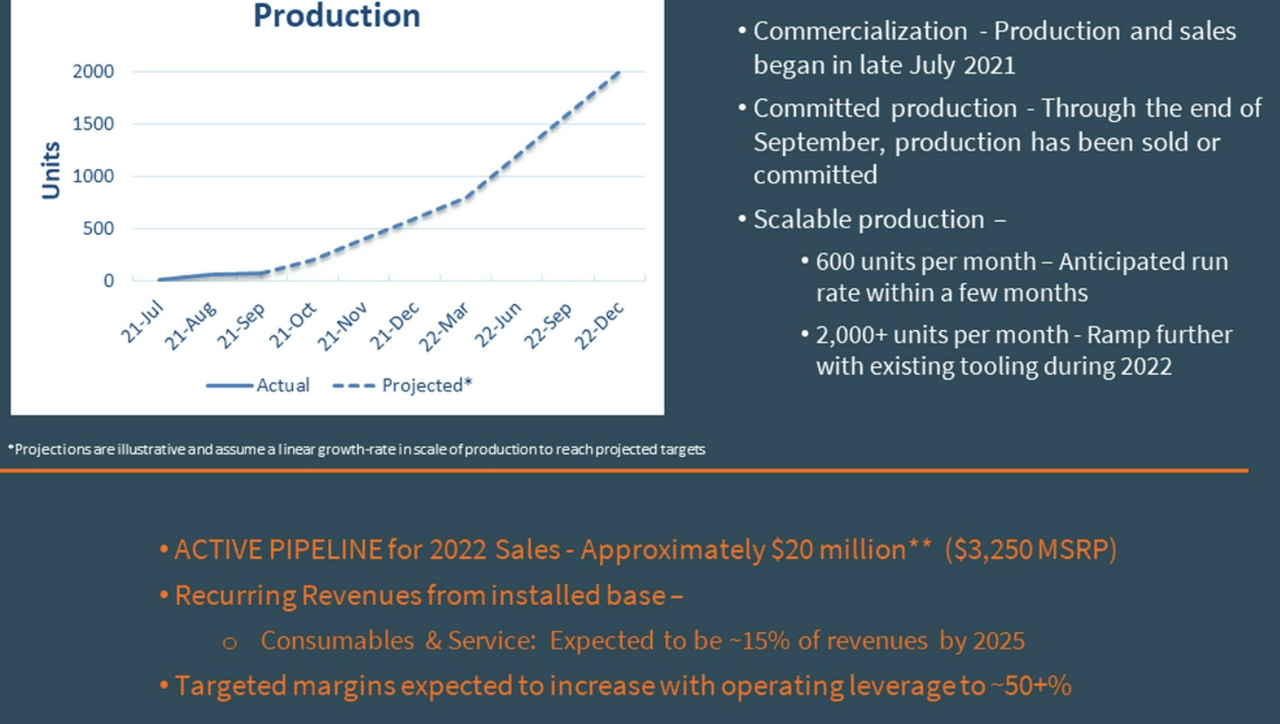

It is also worth considering that AeroClean expects significant increase in production in 2022. Management believes that sales growth could stand at close to $20 million.

Investor Presentation

With that about the target market and the expectations for 2022, I would remain very cautious about this name for several reasons. In the last quarterly report, AeroClean reported logistics and supply chain bottlenecks and shortages, which may create issues in future manufacturing and production.

While we are being negatively impacted by the ongoing global logistics and supply chain bottlenecks and shortages that we highlighted in our fourth quarter 2021 earnings release, our mission has been bolstered by a number of initiatives and significant funding for governmental efforts to improve indoor air quality at the federal and state levels and within various regulatory bodies. Source: AeroClean Reports First Quarter 2022 Financial Results – AeroClean

In my view, the most serious factor is that AeroClean expects shortages to affect future production. I wonder whether AeroClean may lower its guidance for the full year 2022. In that case, I believe that the stock price could decline.

The continued shortages impacted the ability to manufacture units during the first quarter, the weekly and monthly production run rates we expected to achieve during the first quarter and will likely impact the run rates we expected to achieve for the remainder of this fiscal year. Source: AeroClean Reports First Quarter 2022 Financial Results – AeroClean

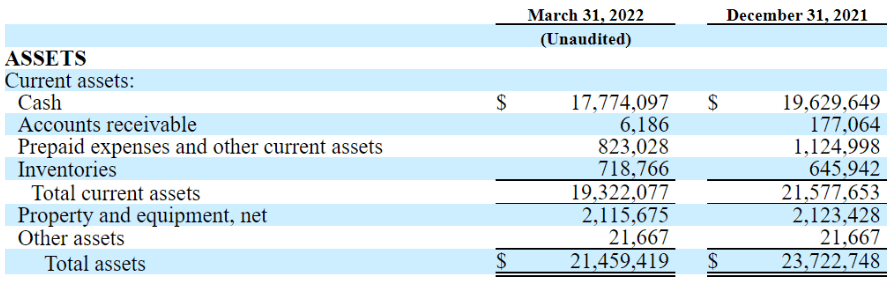

With $21 Million In Total Assets, AeroClean Appears Overvalued

With $17 million in cash, $21 million in total assets, and $1.6 million in total liabilities, AeroClean’s financial situation is healthy. With that, I can’t really explain how AeroClean could have a market capitalization of more than $99 million in June 2022.

First Quarter 2022 Financial Results

I wouldn’t be worried about the company’s total amount of liabilities and long-term debt. As of March 31, 2022, AeroClean does not seem to report debt. The largest liability is accounts payable, which is worth $0.4 million.

First Quarter 2022 Financial Results

AeroClean’s DCF Model Implies Significant Downside Risk

The global UV disinfection equipment market is expected to grow at a CAGR of 12.5% from 2019 to 2026. AeroClean is quite small, and already exhibits significant sales growth, so I believe that the company will grow at a larger pace than the market for some time:

The market was estimated at USD 2.5 Billion in 2019 and is expected to reach USD 5.9 Billion by 2026. The global UV Disinfection Equipment Market is expected to grow at a compound annual growth rate of 12.5% from 2019 to 2026. Source: At 12% CAGR, Global UV Disinfection Equipment Market

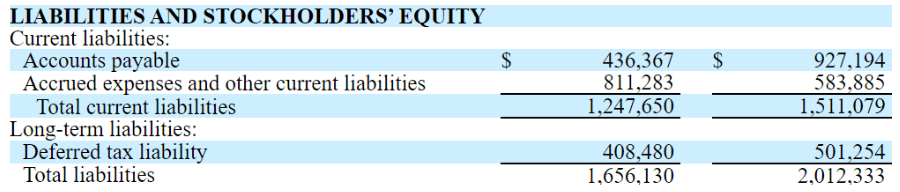

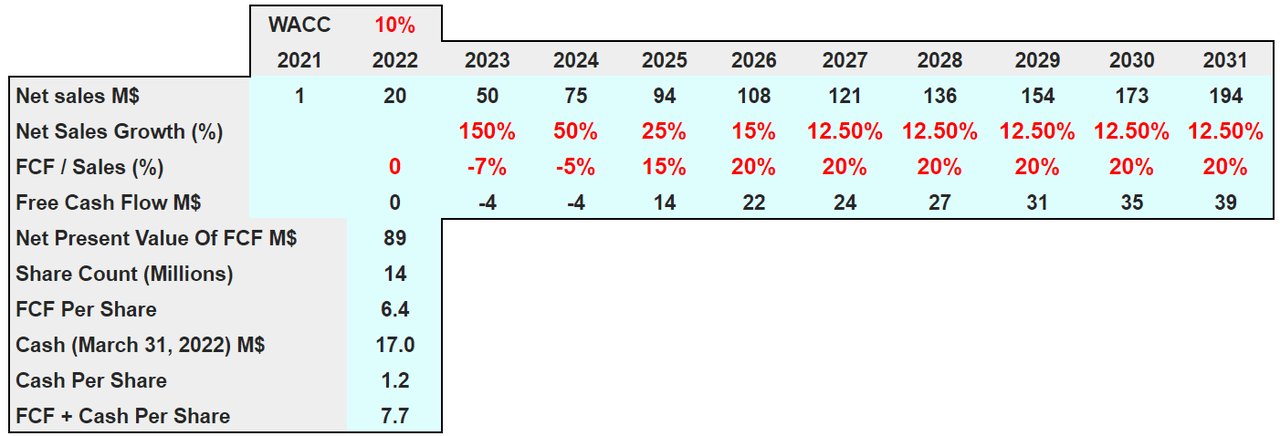

I included the assumptions of management of $20 million in 2022 revenue and 12.5% sales growth from 2027 to 2031. Competitors report free cash flow margin close to 20%, so I used this figure in my model.

YCharts

In a model that includes a discount of 10% and a free cash flow margin close to 20%, the net present value of free cash flow stands at $89 million. If we also add cash worth $17 million and the current share count, the total sum stands at $7.7 per share.

Arie Investment Management

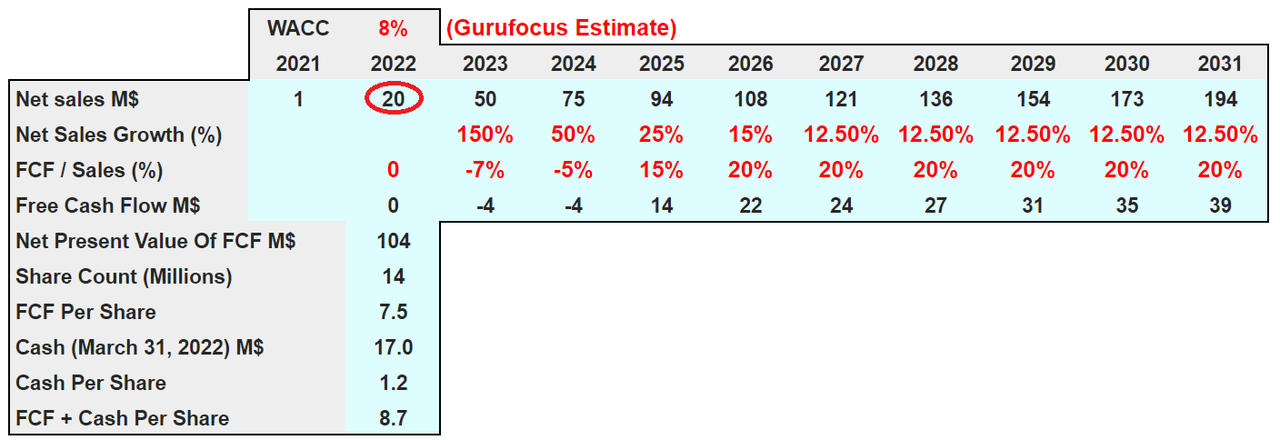

I tried to be a bit more optimistic, but I couldn’t obtain the current market price. With a discount of 8%, which is used by other financial advisors, the free cash flow and the cash per share stand at $8.7. In June 2022, the stock price exceeded $14 per share. I believe that AeroClean appears quite overvalued.

Arie Investment Management

Risks: Lower Revenue Growth Than Expected And Concentration Of Clients

AeroClean cannot guarantee that the Pūrgo device will report significant sales growth. If customers don’t recognize the need for AeroClean’s technologies, revenue growth may be lower than expected. Under the worst-case scenario, I believe that low sales growth would push the stock price down:

In 2021, we generated sales of approximately $0.6 million of the Pūrgo device and, while we intend to promote sales of this product during 2022 and beyond, we cannot guarantee that we will succeed in these efforts. In addition, we may not be successful in developing or acquiring additional products. Any failure to expand sales of our Pūrgo device, or any failure to obtain market acceptance of our product, would have a material adverse effect on our financial condition, results of operations and business. Source: 10-k

AeroClean is working with an external manufacturer called Mack Molding for the production of the Pūrgo device. Many medical device companies out there do this. However, in my view, it is worth mentioning that AeroClean’s EBITDA margin would be larger if AeroClean would produce its own devices. The company appears to own only Pūrgo’s intellectual property. Besides, if Mack Molding cannot manufacture the product, the company may not find another manufacturer that does it for a similar price.

We do not have our own manufacturing facilities or capabilities. We have engaged Mack Molding, an FDA-regulated subsidiary of the privately held Mack Group, to manufacture the Pūrgo device.

There also can be no assurance that we would be able to secure another manufacturer for our products or do so on terms similar to those with Mack Molding. The inability to have our products manufactured in a timely manner could have a material adverse effect on our business, financial condition and results of operations. Source: 10-K

In 2021, AeroClean reported significant revenue concentration, which may be quite a risk. If one of these customers decides to leave the company, the revenue decline could be quite significant. As a result, the share price may decline.

During the year ended December 31, 2021, our largest and second largest customers accounted for approximately 45% and 12% of the Company’s revenues, respectively. As we roll out the Pūrgo device to a wider group of potential customers, we expect our largest customers may vary from period to period. However, as we continue to market our products and seek to develop and grow our customer base, our revenues and operating results in any given period going forward may materially rely on one or a few significant customers. Source: 10-k

Conclusion

AeroClean is targeting a massive target market and expects to report double-digit sales growth in the near future. The recent information about its conversations with the FDA made the stock price increase significantly. With that, I believe that future free cash flow doesn’t justify the current market price. Assuming double digit FCF/Sales margin and also double-digit sales growth, the implied valuation stands at close to $7.7-$8.7. Besides, the company already noted that the ongoing global logistics and supply chain bottlenecks could harm the production of new devices. With all these in mind, for the moment, I will remain cautious about the stock.