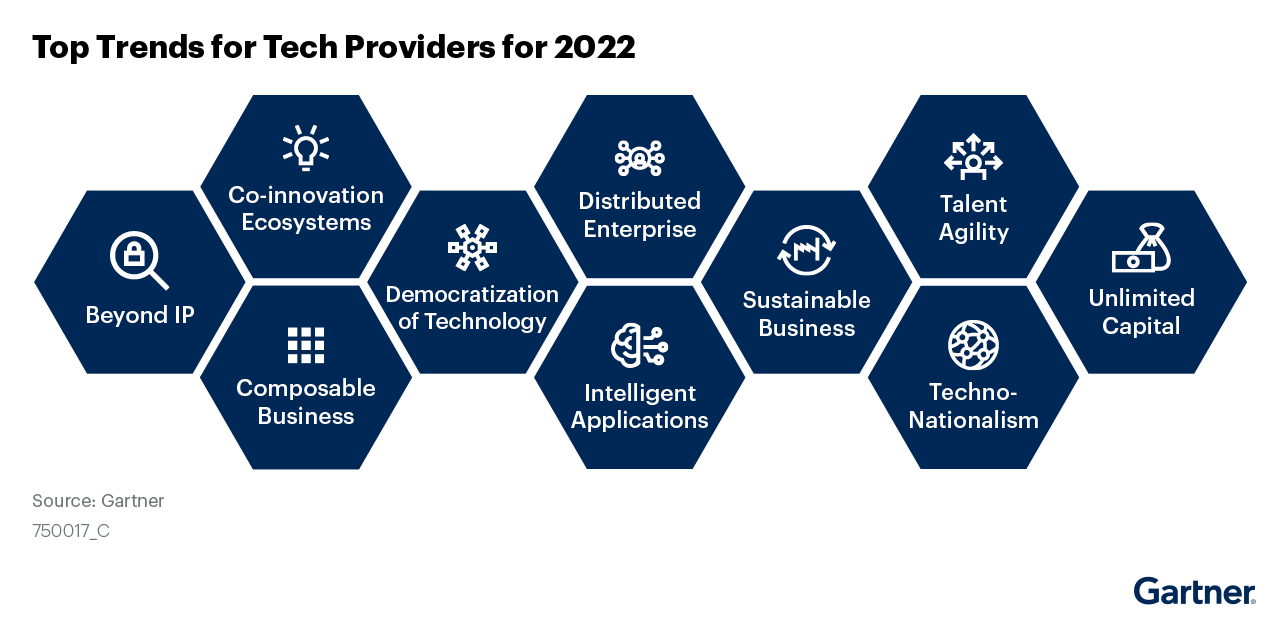

The top trends driving technology providers in 2022

Technology’s impact on society and national economies continues to intensify, in turn increasing the business responsibilities of technology service providers and what their customers expect from them.

This deeper entrenchment in business has also made technology providers much more sensitive to factors beyond information technology. It’s no longer sufficient for them to address client needs and provide quality products. Rather, they have to be aware of the broader economic, social and technological forces that have come to form a large bearing on their business.

Such forces make up this year’s top trends for technology service providers, or TSPs for short (below).

Co-innovation ecosystems

Technology innovation is at the heart of every TSP. However, in the digital world — with much stronger interconnections among technology providers, customers, partners and governments — traditional siloed innovation practices such as research and development and basic product development will not be enough to survive.

Instead, a co-innovation ecosystem is an emerging approach that accelerates the development of solutions to industry problems, spreads risk and cost across the participants, and drives adoption of the end solution. It enables internal, external, collaborative and co-creative ideas to be converged and directly tied to value creation with the “shared revenue/value” among ecosystem stakeholders and participants.

Engagement, co-creation and compelling experiences for value creation are at the core of co-innovation. Product development and the value of co-innovative organizations are thus difficult to replicate by competitors.

In fact, by 2023, 30% of all revenue-bearing emerging technology solutions will be developed via co-innovation ecosystems, enabling vendors to become more competitive and expand into new markets.

Sustainable business

Sustainable business is a strategy that incorporates environmental, social and governance or ESG factors into decision-making. It is underpinned by sustainable technology, a framework of solutions that enable ESG outcomes.

Growing sustainability-driven product investments and deployments are taking place across numerous categories such as sustainable IT — for example, cloud sustainability or green software development — smart energy infrastructure and circular product innovation.

In the end, tech providers that can quantify their offering’s positive contribution to customers’ sustainability objectives will increase their win rate by 20% by 2025.

Talent agility

The post-pandemic pace of TSPs’ business can no longer be accommodated by rigid and fragmented talent management processes. This is where talent agility comes in – the ability to support talent needs for business agility through a combination of skills and talent supply analysis, and by connecting fragmented existing and new talent pools without borders.

Talent agility will affect six key areas of TSP business: products and services, customers and buyers, operations and processes, competitive landscape, and partners and ecosystems.

By 2025, 30% of TSPs will create a single talent network to connect up to six separate talent pools, up from fewer than 5% today.

Techno-nationalism

Digital sovereignty laws and regulations are growing in scope and accelerating in most major markets, giving a short-term window for market expansion to solidify a presence for TSPs.

As competition across country borders and purview declines, and more restrictive digital usage laws expand, prices are expected to increase, creating revenue opportunities for those with scale and reach. Governments, too, will become increasingly aware of the value of citizen data.

By 2026, nationalistic and protectionist value-based economic systems will grow 10 times globally, disrupting more than 80% of all technology companies’ go-to-market and product strategies. Product leaders will need unique, digitally distinctive operating architectures that are compliant to social, legal and economic zones by region.

Democratization of technology

The democratization of technology empowers non-IT workers to select, implement, produce and custom fit their own technology. Product leaders must embrace the new opportunities this trend offers and meet the needs of a new set of citizen developers and business technologists, or struggle to deliver compelling solutions and experience eroding market positions.

After all, by 2024, 80% of technology products and services will be built by those who are not full-time technical professionals.

Intelligent applications

Intelligent applications use data and machine learning to generate a continuous learning system that provides adaptive and contextualized experiences. For example, emerging intelligent applications might generate new financial products and services based on customer data or create new customer experiences such as autonomous business operations in retail stores or automated workflows and fleets within mining.

Enterprise stakeholders intuitively embrace the principles and promises of intelligent applications, and will only continue to do so. In a recent Gartner end-user survey focused on emerging technology adoption, the mean investments in intelligent applications over the past 12 months was $408,000, and the mean value of planned investments in intelligent applications within 2022 is $618,000.

Distributed enterprise

Organizations are shifting toward “distributed enterprise” to support hybrid work, remote delivery and digital experience at all touch points. In this business model, there is growing demand for technology solutions and tools that can support a predominantly non-office workplace and accelerated digital transformation initiatives to support distributed delivery for clients.

Tech providers must respond to these shifts by prioritizing technologies and product capabilities that blend the digital and physical worlds. By 2023, 75% of organizations that exploit distributed enterprise benefits will realize revenue growth 25% faster than competitors.

Composable business

Composable business is a concept where leaders can quickly build new business capabilities by assembling digital assets in an organization that is architected for real-time adaptability and resilience in the face of uncertainty. It impacts all facets of tech providers’ business as it enables enterprises ability to respond to the market and seize digital opportunities faster and cheaper.

Seven percent of respondents in the 2022 Gartner CIO and Technology Executive Survey indicated that they have already invested in composable enterprise, but an additional 60% expect to have done so by the end of three years.

Composable business is certainly a market shift but does open up new markets for TSPs.

Beyond intellectual property

Historically, protecting and controlling ideas and inventions equaled advantage. IP strategies such as patents represented a powerful way of generating value and are the cornerstone of traditional high-tech strategies. But their role is changing.

“Beyond IP” recognizes the rise of alternative approaches for realizing value from ideas, inventions and other proprietary assets. Rather than creating proprietary IPs with finite boundaries to be defended, new leaders seek a pool of ideas and insight with fluid boundaries whose value increases through application that builds the next set of ideas.

IP and intellectual capital or IP/IC protection strategies based on “fixing ideas” into patents and so forth will reduce the value of the IP/IC by up to 50% over the next five years.

Unlimited capital

Unlimited capital is the trend in which there is such an abundance of capital competing for investment in private companies, that tech providers have access to virtually unlimited amounts of capital at a low cost. Startups that can successfully demonstrate product market fit can raise dramatically larger rounds of financing at earlier stages of development, allowing them to accelerate growth without regard to capital efficiency or risk.

Rajesh Kandaswamy (@rajeshakan) is a distinguished analyst vice president and fellow at Gartner Inc. who advises C-level executives and product leaders on the strategic impact of emerging technologies. He wrote this article for SiliconANGLE. Join Rajesh and his colleagues at the Tech Growth & Innovation Conference, taking place virtually July 12-13, 2022.