Why Micron Technology Stock Fell More Than 2% Today

What happened

Shares of memory chip manufacturer Micron Technology (NASDAQ: MU) fell 2.2% today. In fact, the stock is down some 10% since Micron reported earnings on the evening of March 29. It was a solid quarterly update, one that beat expectations and showed Micron’s momentum continuing through this year as the world continues to suffer from a shortage of chips.

So what

As for specific numbers, Micron management said that in the second quarter of fiscal 2022 (the three months ended March 3), sales and adjusted earnings rose 25% and 118% year over year, respectively. Pricing on its memory chips is expected to rise at a double-digit percentage for the balance of the year as demand for electronic components continues to outpace the supply Micron can crank out.

That means at least a couple more quarters of strong growth is likely. So why the glum mood among Micron investors? Some stock analysts are beginning to sound the alarm on the industry, noting that white-hot demand (especially for consumer devices) might start to ease in 2023.

Notably, Barclays analysts led by Blayne Curtis downgraded Advanced Micro Devices (NASDAQ: AMD) this week from outperform to perform, citing a possible slowdown in growth next year.

Now what

Perhaps Micron is falling in sympathy with AMD. This makes sense, given that digital memory chips are a basic commodity included in more-complex semiconductor units and computing devices (like what AMD designs). If higher-order chip companies sneeze, Micron could catch cold. Historically, this has been the case. The semiconductor industry is cyclical, and Micron especially so.

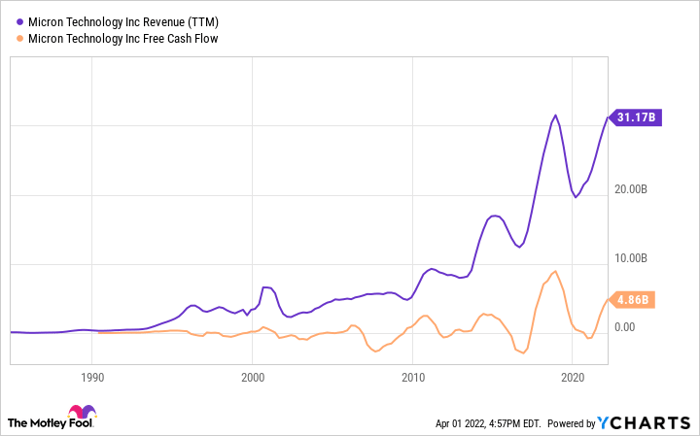

Data by YCharts. TTM = trailing 12 months.

However, there are undeniable secular growth trends propelling Micron and the whole semiconductor world higher. Management pointed to its data-center, automotive, and industrial-device segments as areas of particular note on the last earnings call. More-complex technology needs more memory, a trend that should keep Micron sales chugging higher for many years to come (albeit at a more wild up-and-down pace than many of its peers).

The stock trades for less than 10 times trailing-12-month earnings, and less than 18 times trailing-12-month free cash flow. It’s anyone’s guess when the next downturn in chip sales arrives, but Micron has heard this story before. It’s in great financial shape and ready to weather the storm.

10 stocks we like better than Micron Technology

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Micron Technology wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

*Stock Advisor returns as of March 3, 2022

Nicholas Rossolillo and his clients own Advanced Micro Devices and Micron Technology. The Motley Fool owns and recommends Advanced Micro Devices. The Motley Fool recommends Barclays. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.